Welcome to our full publication on navigating the world of credit results and homeownership! If you have ever dreamed of getting home, you are in the right place. Understanding the particulars of your credit rating is essential having gaining one mission and guaranteeing an informed resource terms and conditions for the their mortgage.

Contemplate your credit rating such as for example an economic fingerprint unique to you personally that have significant impact on what you can do so you’re able to use money, also to possess home financing. Within blog site, we’ll demystify the thought of credit scores, address common concerns you to definitely homeowners will often have, and you may highlight just how your credit rating make a difference all the step of one’s homebuying excursion.

Very, regardless if you are an initial-big date homebuyer desperate to take you to definitely monumental step otherwise a seasoned homeowner trying brush abreast of your own borrowing studies, read on for more information on the latest ins and outs off credit scores!

Preciselywhat are fico scores?

Your credit score are an effective three-digit count representing the creditworthiness and indicates so you can lenders just how more than likely youre to repay borrowed money on date. Its generally a mathematical report on your credit history and you will monetary decisions.

Credit scores generally speaking consist of 3 hundred and you can 850, with high score appearing a lesser risk to possess lenders and better creditworthiness. The better your credit score, the more likely youre so you’re able to qualify for positive loan conditions, such all the way down rates of interest and better borrowing restrictions.

What is good good credit rating?

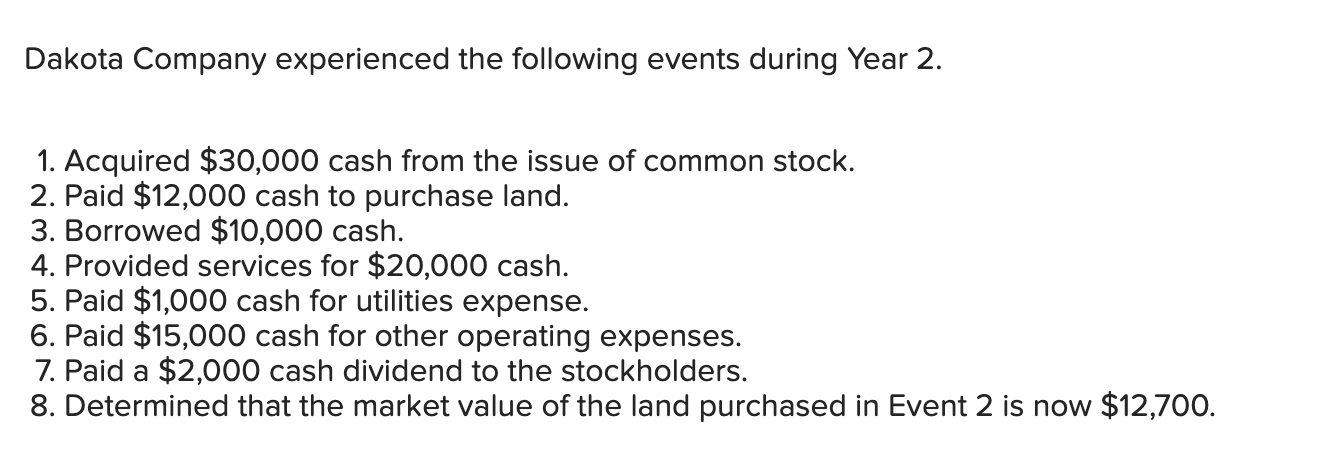

Considering FICO, good credit are 670 or higher. The following is a writeup on most of the FICO Get range:

- Exceptional: 800 to 850

- Decent: 740 in order to 799

- Good: 670 so you’re able to 739

- Fair: 580 to 669

- Poor: 3 hundred to help you 579

Just how was my credit score determined?

Credit scores are calculated considering some things produced by their credit file. Because real formulas utilized by credit scoring patterns was exclusive, sometimes they take into account the following key factors:

Commission records

Fee record ‘s the checklist of the earlier repayments for the borrowing levels, such playing cards, financing, and you may mortgages. Making your payments timely seriously has an effect on your credit rating, when you are later or skipped repayments can all the way down they.

Credit use

It refers to the percentage of their readily available borrowing from the bank you are currently using. Maintaining your borrowing usage reasonable, if at all possible below 29%, shows in control borrowing from the bank management and certainly will improve your credit rating.

Duration of credit history

How much time you’ve been playing with borrowing from the bank makes up about an effective significant percentage of your credit rating. Generally, loan providers examine an extended credit rating a lot more favorably because it reveals what you can do to handle credit responsibly and you may continuously historically.

Credit mix

Lenders like to see that one can do different varieties of borrowing from the bank sensibly, eg credit cards, payment loans, and you may mortgages. Having a varied mixture of borrowing from the bank levels normally positively effect the rating.

The latest borrowing questions

Each time you sign up for this new credit, a challenging query is put on your credit report, which can temporarily decrease your credit history. Numerous inquiries inside a brief period strongly recommend you might be positively looking to even more borrowing from the bank, that may indicate monetary imbalance otherwise an unexpected dependence on money and you can laws to help you loan providers your a higher borrowing risk.

Do you know the different varieties of america cash loans in Mignon AL credit scores?

Sure! Loan providers have fun with multiple credit scoring patterns to evaluate borrowing from the bank exposure, but two of the most common is FICO Rating and VantageScore.

FICO Get

Developed by the new Fair Isaac Company, new FICO Get is one of the most widely used borrowing from the bank rating patterns in the us. It ranges off three hundred in order to 850 in fact it is based on pointers regarding three major credit bureaus: Equifax, Experian, and TransUnion. There are numerous products of your FICO Get customized to particular marketplace, such as car and truck loans, credit cards, and you will mortgage loans.