Fool around with the mortgage calculator built in to they! Rating particular prices for your month-to-month mortgage repayments for a moment have to has personal financial insurance (PMI). Along with understand why

svg]:rotate-180″ data-radix-collection-item=””>

When choosing how much cash house you really can afford, perhaps one of the most important pieces to choose is if a great domestic often go with their month-to-month funds. A home loan calculator can help you understand the month-to-month cost of a great home. And you can ours can help you go into more down payments and interest rates to greatly help determine what try affordable to you.

Loan providers determine how much you really can afford for the a monthly homes percentage by figuring the debt-to-income ratio (DTI). The maximum DTI you will get in order to personal installment loans for poor credit Ontario qualify for most mortgage loans is normally between forty-five-50%, together with your forecast houses costs provided.

Their DTI is the balance involving the earnings and your obligations. It can help lenders recognize how safe otherwise high-risk it is getting them to accept the loan. An effective DTI proportion signifies just how much of your own gross month-to-month money is actually spoken to possess of the loan providers, and just how most of it is remaining to you personally given that throw away money. Its most often composed since a share. For example, if you spend 50 % of the monthly money in financial trouble costs, might possess a DTI away from fifty%.

How exactly to determine month-to-month mortgage payments ?

Your monthly homeloan payment includes loan prominent and you will focus, property taxes, home insurance, and you may mortgage insurance coverage (PMI), in the event that appropriate. Without normally used in the mortgage payment, home owners as well as pay monthly resources and regularly shell out homeowners connection (HOA) fees, so it is smart to basis these types of into the monthly funds. That it financial calculator items in all these typical month-to-month can cost you very you can extremely crisis the wide variety.

Algorithm for figuring month-to-month mortgage payments

The simplest way to calculate your own homeloan payment is to use an excellent calculator, but for brand new interested or statistically more inclined, right here is the formula getting calculating dominating and you will interest on your own:

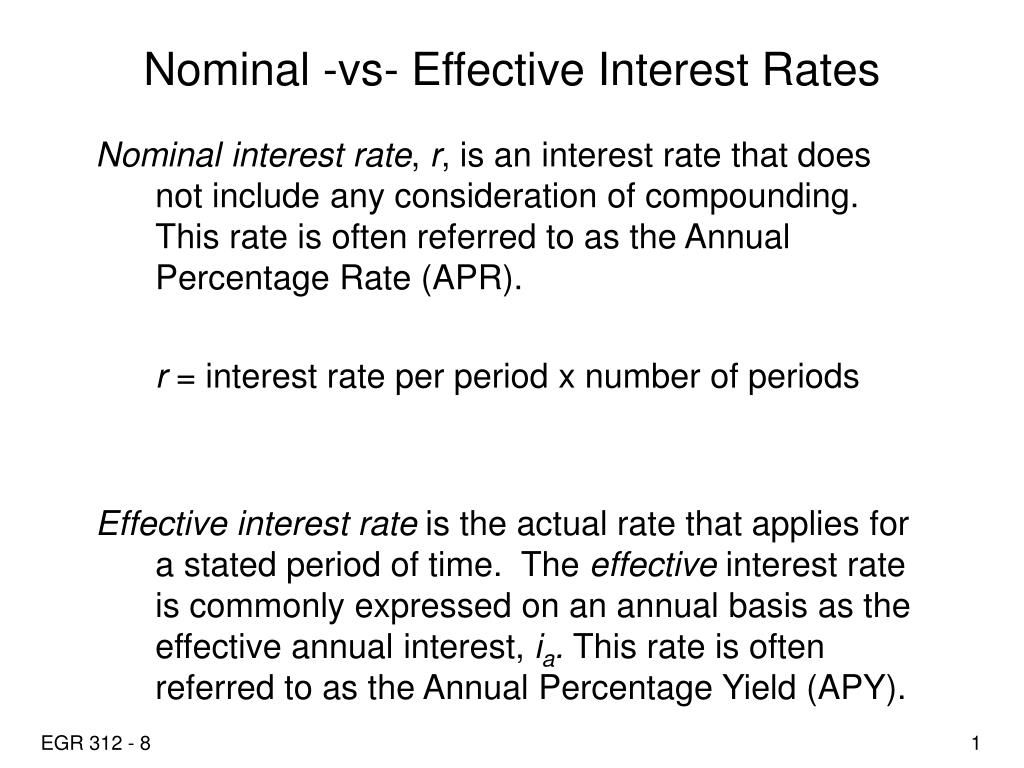

r ‘s the monthly interest(annual rate of interest split by a dozen and you may expressed as the an effective ple:if the annual rate of interest are 5%, brand new month-to-month speed was 0. = .00417, otherwise .417%

Which algorithm assumes a fixed-rate home loan, where in fact the interest rate stays constant on the financing title. And remember, you can still have to add-on taxes, insurance policies, resources, and you may HOA charges in the event that applicable.

Ways to use so it home loan calculator?

Fuss with different home prices, places, off money, rates of interest, and financial lengths to see the way they feeling their month-to-month financial repayments.

Boosting your down payment and coming down your rate of interest and you will home loan label length make your monthly payment drop. Fees, insurance policies, and you may HOA fees will vary from the area. For those who go into an advance payment matter that is lower than 20% of the property price, personal home loan insurance policies (PMI) will set you back would-be put in your monthly mortgage payment. While the can cost you of tools can vary out of condition so you can county, we included a good resources imagine that one can break apart of the services. If you are considering to get a flat otherwise to your a residential district which have a people Organization (HOA), you can HOA fees.

Really the only numbers we haven’t integrated are definitely the money you may need to save getting yearly house restoration/repairs or perhaps the costs away from renovations. To see simply how much household you can afford also these types of will set you back, investigate Finest family affordability calculator.

Enjoyable reality: Assets income tax rates are very nearby, very two land regarding around an identical dimensions and you will high quality on either side of a civil edging may have very different taxation pricing. To purchase during the a place having a diminished property tax price could possibly get make it easier for you to cover the increased-priced home.