Having phone calls growing to possess healthier action to greatly help troubled home owners, debtor advocates is actually hailing home financing-amendment system becoming observed because of the Bank of The united states Corp.is the reason Countrywide device as the most bold effort yet , so you can avert property foreclosure.

A button lawmaker try requiring the remaining domestic-mortgage community adopt the applying, that has been required from the a settlement regarding condition lawsuits alleging one to Countrywide consumers had been systematically tricked into taking out fully expensive financing.

Earlier in the day attempts to personalize mortgage brokers, also a freeze into subprime “teaser” interest rates promoted by the Treasury Assistant Henry Paulson Jr. a year ago, have upset advocates out of high-scale loan exercise.

Government Put Insurance coverage Corp. captain Sheila Bair, whom has just slammed brand new Plant government to have perhaps not creating way more to help you stalk property foreclosure, told a Senate panel Thursday your authorities is provide to guarantee altered mortgage loans because the a reward to possess home loan providers to ease mortgage words.

Her testimony arrived just like the data released Thursday presented what number of parents when cash advance loan South Woodstock you look at the California shedding their houses flower to a record highest of nearly 80,000 within the last 3 months.

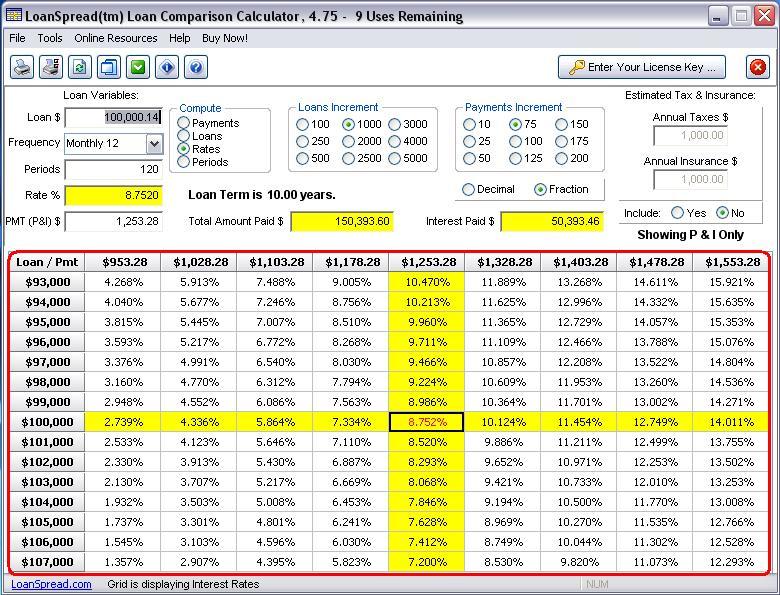

This new Countrywide plan, that is geared towards borrowers having subprime mortgages or spend-choice varying-rate mortgage brokers, also known as choice Fingers, would briefly cut rates to the specific funds so you’re able to because low as 2.5 percent. Certain individuals which are obligated to pay more than their houses are worth you are going to actually find the financing stability reduced, going for collateral once more in their characteristics.

The theory should be to modify an excellent loan’s words adequate in order to do another payment, including dominant, attention, fees and assets insurance rates, equivalent to 34 % off a good borrower’s earnings.

The financial institution together with wanted to spend on average $dos,000 so you can individuals that destroyed their houses — or who’ll get rid of all of them because they don’t qualify for the newest system

Financial out of The usa authorities state they have gotten permission for the changes in the most the top banking companies, investment money and you can organizations so you’re able to just who Nationwide ended up selling much of their finance when you are continuous to solution all of them. For example people has actually prohibited of numerous before jobs to change funds, centered on Countrywide and other loan servicers.

An effective spokesman to own U.S. Agent. Barney Honest, D-Size., president of the house Monetary Services Panel, known as program “the first it really is full plan we viewed throughout the individual sector.”

Frank a week ago provided ten most other biggest home loan servicing companies an enthusiastic ultimatum to consider software the same or much like the Countrywide package. Should your servicers never comply, “We are going to generate laws one does it for them,” told you Steven Adamske, a good spokesman on lawmaker.

Giving the efforts some white teeth, the new settlement lets the official authorities exactly who charged, as well as Ca Attorney General Jerry Brownish along with his alternatives inside the Illinois and you may Florida, the legal right to gap the fresh settlement and you will reopen the new litigation if the Countrywide will not personalize fifty,000 definitely unpaid funds across the country because of the February 1

“One to sounds like great news, particularly in the event that a large part of other financing servicers wade along with it,” said Robert Gnaizda of one’s Greenlining Institute, a borrower advocacy classification.

Although momentum try collecting having stronger jobs to assist property owners within the distress, such as for example a move could well be certain to build a comparable form away from sour resistance that greeted a narrower property foreclosure-cures energy introduced of the Plant government past December as well because $700 mil guidelines passed three weeks hence so you’re able to help save brand new monetary system.

Within the Nationwide payment, the lending company and its subprime tool, Complete Range Credit, promised to look at altering whatever loan having individuals whom can’t afford their payments. The fresh accord, not, calls for highest-size improvement out-of merely two types of top mortgages: subprime loans and solution Fingers.

In other provisions, Countrywide agreed to waive prepayment charges and late charge into disappointed mortgage loans in order to frost the property foreclosure process to own individuals until their financing is modified or it is determined that the fresh consumers usually do not be considered. The target is to tailor 395,000 financing, according to Nationwide, and that turned the new No. step one You.S. household financial because of the aggressively generating subprime and you can exotic money on top of that in order to traditional mortgages.