Could you be an initial home customer? Work-out the fresh deposit you will want initial in order to satisfy the purchase rates, other costs you have to keep in mind when buying an excellent domestic, and how to get into your property eventually.

Guide a scheduled appointment

A faithful bank becomes into touching along with you contained in this 1 working day. Might answer your questions regarding mortgage brokers and you may guide you because of second actions. Your own lender should be able to begin the applying for your requirements.

After you have discovered a house that meets your financial budget, it’s time to work out just what put you could establish. A more impressive put means you will have to borrow quicker, which means you’ll shell out less interest and you will probably straight down month-to-month payments.

Always, 20% of your own full value of the house is a great count to aim to have as a deposit. You might still rating that loan when you yourself have an inferior deposit, you may prefer to sign up for Lenders Financial Insurance (LMI) and therefore adds an additional cost with the financing. It’ll along with take more time to repay.

Most lenders use a loan to really worth (LVR) calculation to evaluate extent they are happy to lend to own a mortgage. LVR ‘s the quantity of your loan compared to the Bank’s valuation of your house, shown as the a percentage.

Such as for instance, financing away from $400,000 to buy a home really worth $five hundred,000 results in financing to help you well worth ratio out of 80%. Finance companies place a threshold into the mortgage so you can well worth ratio mainly based for the things like the kind of assets, the spot along with your budget.

Once you know the total amount you need to purchase the home, plus the measurements of put you will need, play with our house Saver Calculator so you’re able to with ease exercise just how long it may take to save the new put to suit your new home.

Almost every other upfront will set you back to consider

There is certainly a whole lot more to buying a property than the cost of the house by itself. There are various other upfront will set you back you will need to understand.

Stamp obligation

Stamp Obligation are a state and area authorities income tax that may vary according to things like place, should it be a primary domestic otherwise an investment, plus the cost of the property. It is important you’re taking so it into account while looking purchasing a house all of our Stamp Duty calculator may help give you a concept of simply how much it.

Courtroom will cost you

Several legal methods are involved when selecting possessions. Conveyancing (the fresh deals and you will transfer away from a residential property) include a home and you will label browse, the newest remark and replace of one’s offer regarding marketing, the newest import of one’s identity, or any other issue also.

Home loan facilities and you can subscription costs

These may rely on the official in which you real time and exactly who the lender is. Knowing if these apply at you is even crucial. Discover more about the newest upfront will cost you of buying a house

Circumstances that apply to your loan and you may interest

Now you discover your spending budget, how much you need to suit your deposit, therefore the most other possible upfront will cost you. And such, there are lots of additional factors one to ount a loan provider are ready to loan both you and the interest rate they could costs.

Your credit report and you can rating assists loan providers determine your ability in order to pay off and you may do credit, that may impact the sized the loan therefore the attract price. Increased credit score can see large loans from the straight down cost, when you are a reduced score you will understand the reverse.

With a benefit decide to assist gather your own put is actually a great way to direct you can meet mortgage payments and, ensure that you are making normal repayments on the playing cards and other credit factors you have got, to simply help raise your credit history.

Help for first time people

The government possess a one-of fee that can easily be made to very first-day homebuyers, helping them toward the basic family. The quantity, requirements and information having a first Home owner Give cover anything from states and regions, therefore consult your lender otherwise have a look at the fresh new Federal Government’s First Resident Give website for more information.

Which have an economy propose to help accumulate your put was good fantastic way to make suggestions can meet mortgage repayments including, make certain you will be making regular repayments to your credit cards and other borrowing from the bank circumstances you have, to aid improve credit score.

Really loan providers wanted in initial deposit with a minimum of 20%, and work out preserving getting in initial deposit a genuine hindrance in order to home ownership. Towards the Australian Bodies initiated Domestic Make certain Plan, first-go out homebuyers you are going to quick-track home ownership ambitions having certainly one of three be sure choice step one .

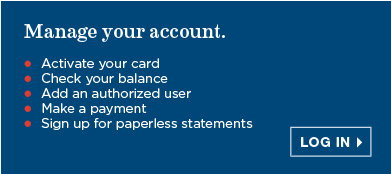

Knowing your limitation installment loans in Ontario borrowing fuel

Your borrowing from the bank power relies on your personal situation, lifestyle, income, costs, credit history, and other activities. If you’d like to guess the borrowing from the bank power easily and quickly, go after the borrowing power calculator.